Form 8912 Credit to Holders of Tax Credit Bonds 2021

Understanding Form 8862

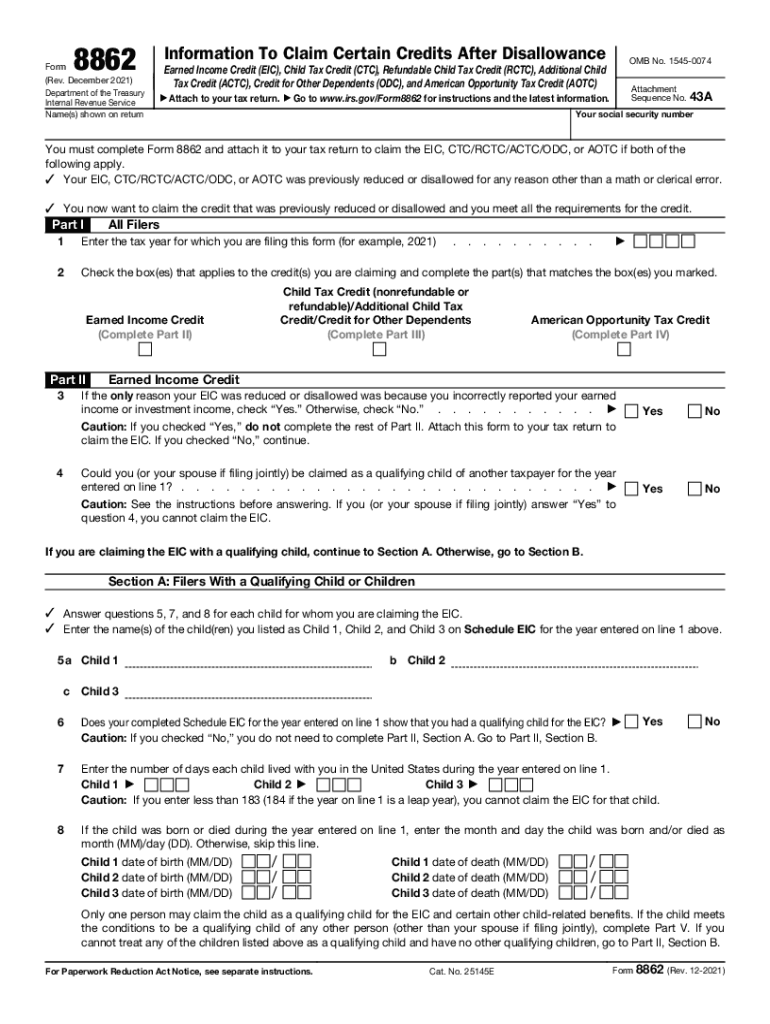

The form 8862, officially known as the IRS Form 8862, is utilized by taxpayers who wish to claim the Earned Income Tax Credit (EITC) after having previously been disqualified. This form is essential for those who want to demonstrate their eligibility for the credit following a prior denial. Understanding the purpose and requirements of this form is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Eligibility Criteria for Form 8862

To qualify for the IRS form 8862, taxpayers must meet specific eligibility criteria. These include:

- Having been disqualified from claiming the EITC in a previous tax year.

- Meeting the income requirements set forth by the IRS for the current tax year.

- Providing accurate information regarding qualifying children, if applicable.

It is important to review these criteria carefully to ensure that all conditions are met before submitting the form.

Steps to Complete Form 8862

Completing the form 8862 involves several key steps:

- Gather necessary documentation, including previous tax returns and records of income.

- Fill out the form accurately, ensuring that all personal information is correct.

- Provide details regarding any qualifying children, if claiming the credit based on dependents.

- Review the completed form for accuracy before submission.

Following these steps can help ensure that the form is completed correctly and submitted on time.

Filing Deadlines for Form 8862

Taxpayers must be aware of the filing deadlines associated with the IRS form 8862. Typically, the form must be submitted along with the annual tax return by the tax filing deadline, which is usually April 15. If additional time is needed, taxpayers may file for an extension, but it is important to note that the extension does not apply to any payments owed.

Form Submission Methods

The form 8862 can be submitted through various methods:

- Electronically through tax preparation software, which often includes built-in guidance for completing the form.

- By mail, sending the completed form directly to the appropriate IRS address based on the taxpayer's location.

Choosing the right submission method can facilitate a smoother filing process and ensure timely processing of the tax return.

IRS Guidelines for Form 8862

The IRS provides detailed guidelines regarding the use of form 8862. Taxpayers should familiarize themselves with these guidelines to ensure compliance. Key points include:

- Understanding the consequences of incorrect information, which can lead to delays or disqualification from the EITC.

- Recognizing the importance of submitting the form in conjunction with the tax return to avoid complications.

Adhering to IRS guidelines is essential for a successful filing experience.

Quick guide on how to complete form 8912 credit to holders of tax credit bonds

Effortlessly Prepare Form 8912 Credit To Holders Of Tax Credit Bonds on Any Device

The management of online documents has gained signNow traction among both organizations and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Manage Form 8912 Credit To Holders Of Tax Credit Bonds on any device using the airSlate SignNow apps available for Android or iOS and simplify any document-related process today.

The Simplest Method to Alter and Electronically Sign Form 8912 Credit To Holders Of Tax Credit Bonds Effortlessly

- Access Form 8912 Credit To Holders Of Tax Credit Bonds and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Form 8912 Credit To Holders Of Tax Credit Bonds and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8912 credit to holders of tax credit bonds

Create this form in 5 minutes!

How to create an eSignature for the form 8912 credit to holders of tax credit bonds

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is form 8862 and why is it important?

Form 8862 is a tax form that is used to claim the Earned Income Tax Credit (EITC) or the Child Tax Credit after a disallowance. It is important because it allows taxpayers to reclaim these credits if they believe they qualify again, following a previous rejection. Ensuring proper use of form 8862 can signNowly affect your tax refund.

-

How can airSlate SignNow help with form 8862 submissions?

airSlate SignNow provides an easy-to-use platform to send and eSign form 8862 documents securely. Its streamlined processes ensure that you can quickly fill out, sign, and send your form 8862, reducing the time spent on tax-related paperwork. The platform's efficiency allows you to focus more on your financial planning.

-

Is there a cost associated with using airSlate SignNow for form 8862?

Yes, there is a cost for using airSlate SignNow, but it is a cost-effective solution for managing form 8862 submissions and other documents. Pricing varies based on the features you select, ensuring you only pay for what you need. The investment can lead to signNow time savings and improved productivity.

-

What features does airSlate SignNow offer for processing form 8862?

airSlate SignNow offers features such as customizable templates, electronic signatures, and secure document storage for processing form 8862. These features facilitate a smooth workflow, making it easier to manage your submissions efficiently. Additionally, the audit trail ensures that all actions taken on the form are documented.

-

How secure is the signing process for form 8862 with airSlate SignNow?

The signing process for form 8862 with airSlate SignNow is highly secure, employing robust encryption and authentication protocols. This ensures that your sensitive tax information is protected throughout the entire signing and submission process. Using airSlate SignNow gives you peace of mind regarding your document security.

-

Can I integrate airSlate SignNow with other software for my form 8862?

Yes, airSlate SignNow offers integrations with various productivity and business software to enhance your form 8862 processing. Whether you're using accounting, CRM, or document management systems, integration can streamline your workflow and improve efficiency. This flexibility makes airSlate SignNow a suitable choice for many businesses.

-

What are the benefits of using airSlate SignNow for form 8862 over traditional methods?

Using airSlate SignNow for form 8862 provides considerable benefits over traditional methods, such as reduced processing time and increased accuracy. The electronic signing feature allows users to sign documents remotely, eliminating the need for physical paperwork. Additionally, the automated features minimize human error, making your submission process more reliable.

Get more for Form 8912 Credit To Holders Of Tax Credit Bonds

- Letter from landlord to tenant as notice to remove unauthorized inhabitants idaho form

- Shut off notice sample 497305548 form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat idaho form

- Notice of appeal idaho form

- Appeal order form

- 3 day notice to pay rent or lease terminated for residential property idaho form

- Idaho termination form

- Idaho 3 day form

Find out other Form 8912 Credit To Holders Of Tax Credit Bonds

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document